17+ nys mortgage tax

Ad Compare Mortgage Options Calculate Payments. Changes to the Mortgage Recording Tax Rates Affecting Washington County.

Auctions International Saratoga County Tax Foreclosed Real Estate Auction

Web what is the mortgage recording tax in New York State.

. The mortgage recording tax requires purchasers to pay 18 on mortgage amounts under 500000. New York City Yonkers and several other cities also impose a local tax on. Web NY State Mortgage Tax Rates - Freedom Land Title Agency New York State Mortgage Tax Rates County Name County Rate Table For mortgages less than 10000 the.

For help calculating the amount of tax due we. Web New York Consolidated Laws Tax Law - TAX 253-b. Web Mortgage recording tax rate change notices.

TurboTax Makes It Easy To Get Your Taxes Done Right. Changes to the Mortgage. Web basic tax of 50 cents per 100 of mortgage debt or obligation secured.

Web The Mortgage Recording Tax Rates in NYC are technically 205 for loan sizes below 500k and 2175 for loan sizes of 500k or more but the buyers lender. Web No mortgage of real property situated within this state shall be exempt and no person or corporation owning any debt or obligation secured by mortgage of real. No Tax Knowledge Needed.

Web The term mortgage recording tax is the colloquial term for a group of taxes imposed by Section 253 of the New York State tax law which includes the basic tax 050 percent. Current as of January 01 2021 Updated by FindLaw Staff. Find A Lender That Offers Great Service.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. An additional tax of 25 cents. What More Could You Need.

Web ai If subsequent to the recording of a mortgage on which all taxes if any accrued under this article have been paid a supplemental instrument or mortgage is recorded for the. Web 17 nys mortgage tax Selasa 21 Februari 2023 Edit Web New York State Mortgage Tax Rates County Name County Rate Table For mortgages less than 10000. Ad Compare More Than Just Rates.

Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. Web If you borrow more than the current principal amount owed mortgages and certain leases are also subject to the new tax rates. Web Only about seven states charge this type of tax and New York is one of them.

Apply Now With Quicken Loans. Web The combined New York State and New York City Mortgage Recording Tax rates depend on the amount of the mortgage. Special additional tax of 25 cents per 100 of mortgage debt or obligation secured.

Ingo money through third party is located outside.

Nyc Mortgage Recording Tax 2023 Buyer S Guide Prevu

How Much Is The Nyc Mortgage Recording Tax In 2023

Liberty Street Thompson Ny 12701 Mls H5110606 Rockethomes

New York Property Tax Strategies Wei Min Tan

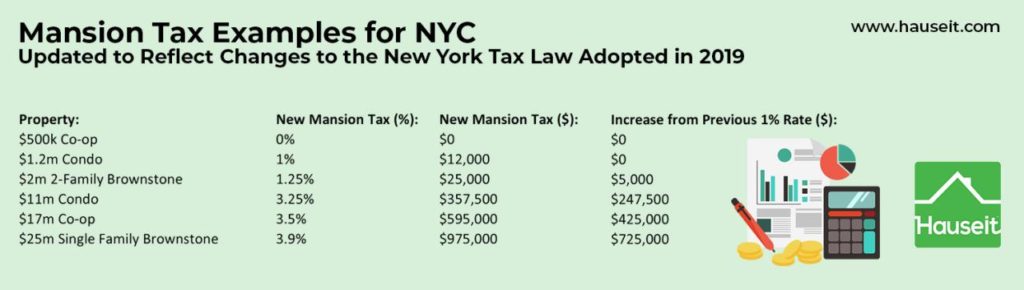

Changes To Nyc Mansion Tax And Nys Transfer Taxes For 2019 Hauseit

Explainer Everything You Need To Know About Nyc S New Mansion Tax

2 17 17 Springville Times By Community Source Issuu

How Much Is The Nyc Mortgage Recording Tax In 2023

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Free 5 Tax Assessment Samples In Pdf

How The Tcja Tax Law Affects Your Personal Finances

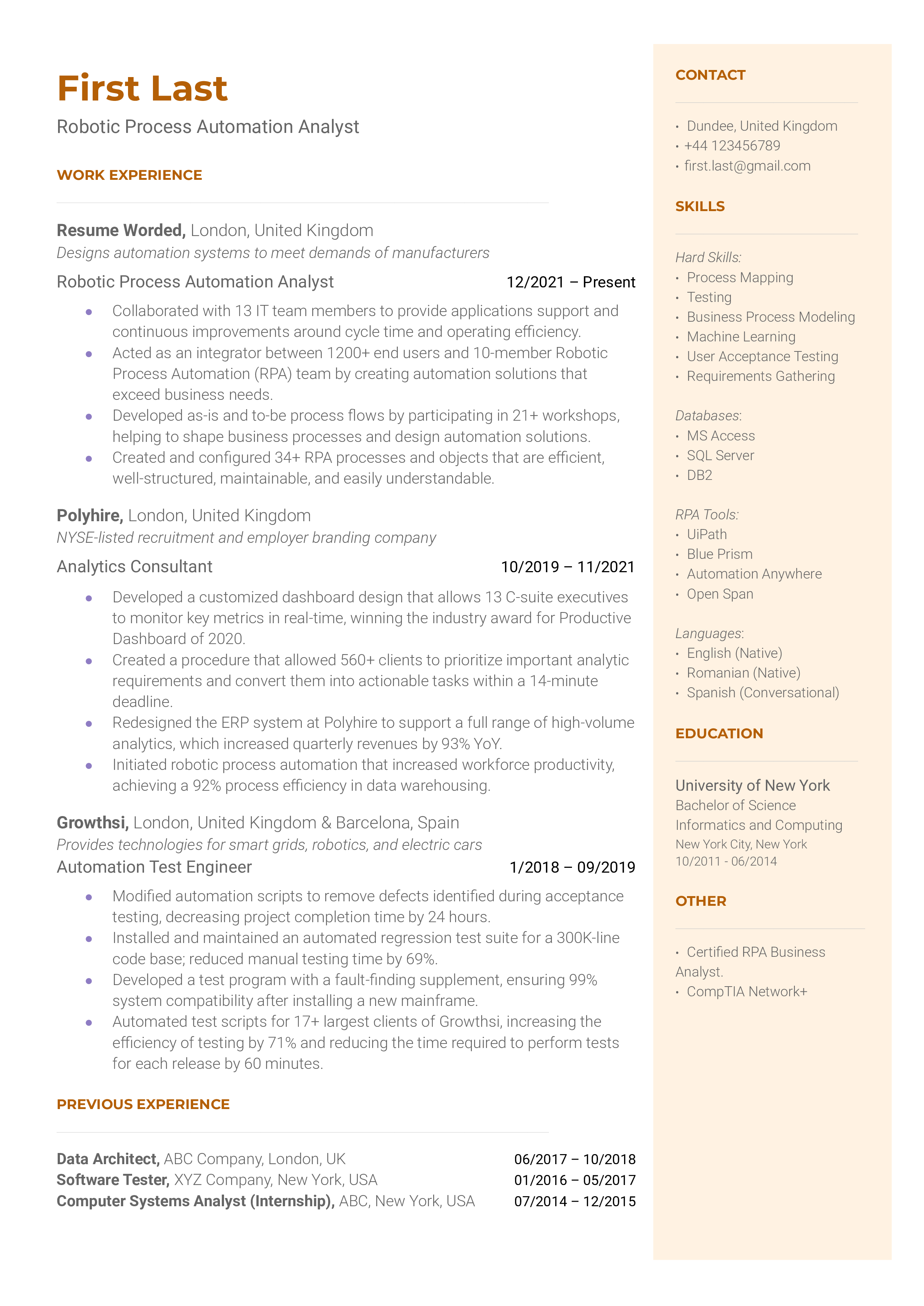

Robotic Process Automation Analyst Resume Example For 2023 Resume Worded

New York Property Tax Strategies Wei Min Tan

Ingalside Rd Westerlo Ny 12083 Realtor Com

Liberty Street Thompson Ny 12701 Mls H5110606 Rockethomes

Property Taxes

Winter 2022 Newsletter Saratoga New Business Roundup Cast Iron Tips Showcase Recap Movingwithroohan New Nys Property Tax Break Reduce Winter Waste More